-

Posts

38,097 -

Joined

-

Last visited

-

Days Won

4

Content Type

Profiles

Forums

Calendar

Posts posted by StrangeSox

-

-

1 hour ago, bmags said:

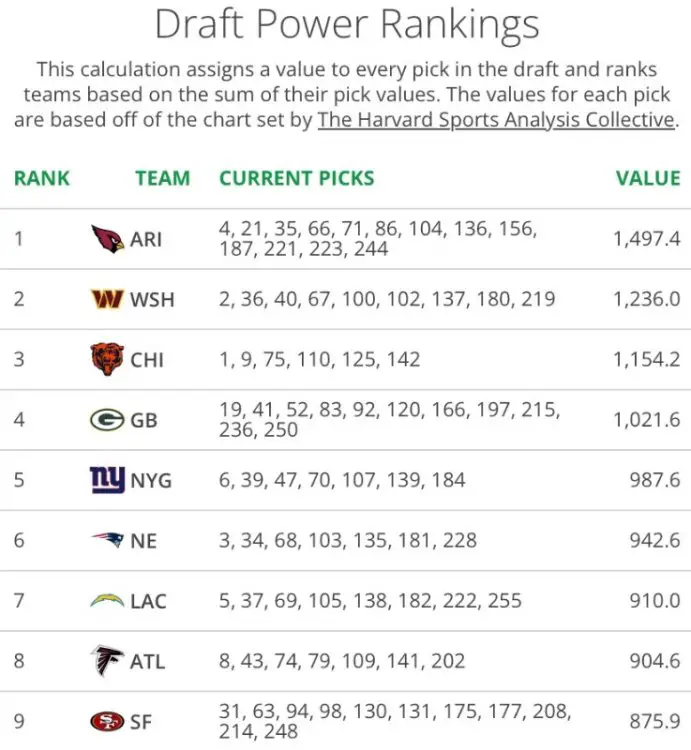

I know the packers are an opposite end here but I see this

and I think to myself the idea that the great QBs were “developed” is extremely overrated.

Feels more like 60% luck, 30% scouting and 10% development.

I think you take the risk on a fields because the arm, accuracy when set and athleticism is worth seeing if he could improve his processing and sack avoidance.

It didn’t work out. And while he could have had better stats in other orgs, I’m honestly not sure the degree better, certainly not to a top 15 QB imo.

Mac Jones' rookie season would be the second best bears QB season ever

-

Very simple solution: the state should eminent domain the White Sox and The 78, making them publicly owned assets. Then it makes perfect sense to publicly finance it!

More seriously, I thought there were a number of studies done 10-20 years ago that found pretty conclusively that sports stadiums don't really end up generating new growth, tourism, tax revenue, and employment.

-

2

2

-

-

1 hour ago, Balta1701 said:

The reason why you’d do this as a taxpayer isn’t baseball, it’s because a state of the art ballpark would be an anchor tenant to develop this site.

FWIW Related Midwest has been looking for a solution for The 78 ever since they lost out to Bally's to build a Chicago casino. That was supposed to be the cornerstone of the development.

U of I still has a research center going in there on south end of the development but I think the rest of the site is currently up in the air

-

-

Just now, Flash Tizzle said:

Their thought process could very well be, we are aware of the trend and purposely won’t fire Eberflus or Poles, regardless of results, to build continuity (and remove that talking point)

How do they make that promise/commitment to any potential incoming OC, though?

-

Love to have another rookie QB tied to a lame duck HC and probably GM. Good luck finding a solid OC to come in under Eberflus.

-

2

2

-

-

11 hours ago, Balta1701 said:

Somehow I wasn’t surprised at all to see the Bears pass on him. They clearly did their homework so if they weren’t sold on the personal issues, I won’t complain.

Do have to hit on the lineman, I’ve seen the Bears miss on several first round OTs.

The Bears hadn't drafted an olinemen in the top 10 in over 40 years. This finally broke that streak.

What I've seen said about Wright is that he should be a fantastic RT.

-

Look, the 2010's weren't the Sox's decade. And the 2020's aren't looking too good, either. But if we continue to place our trust and confidence in Kenny Williams and Rick Hahn, they're going to be right on track for dominating the AL Central come the 2030's!

-

Just remove the cap and bump the upper class tax bracket up 0.5% or something if you really want to recoup the difference for high earners. Avoids all these messy graduated plans and arbitrary cutoffs!

-

Just like they drew it up

-

-

7 hours ago, bmags said:

Holy jobs report.

-

-

The KW/Hahn brain trust has a proven track record

of success. -

2 minutes ago, fathom said:

The front office has no idea what they’re doing. Been obvious for a full year now.

That's a funny way to say 1.5 decades

-

1

1

-

-

Someone made a webpage with a slider to compare the Webb vs. Hubble shots

https://johnedchristensen.github.io/WebbCompare/

-

Suspect in custody at least

-

1

1

-

-

4 minutes ago, reiks12 said:

June home runs:

White Sox: 17

Kyle Shwarber: 8

Just wait until the weather warms up!

-

RIP Mendick's ACL

-

Just now, almagest said:

Not Mendick's ball there, and now he's hurt. Awesome.

not sure what he was doing there

-

-

Vanguard on crypto:

QuoteWe always go back to what we see as our enduring investment principles. And they go to basically investing in stocks, bonds, and cash. And, ultimately, the challenge we have with cryptocurrency is that it doesn't really have an intrinsic value. It's more of a speculative asset class. And so on the one side, again, it doesn't fit from an investment perspective, but the technology behind it is quite compelling. We actually use the blockchain technology today when we get our index data from one of our major providers because it's more efficient, it reduces risk, it just makes a more operationally attractive way of receiving index data. So, again, the technology we think has a lot of value and merit, but, again, investing in crypto, we think that's more of a speculative asset. We don't think that's a great way to construct a long-term portfolio for clients.

-

I'm glad my commute these days is a 2 mile drive to the train station on the occasional day I have to go into the office, though.

-

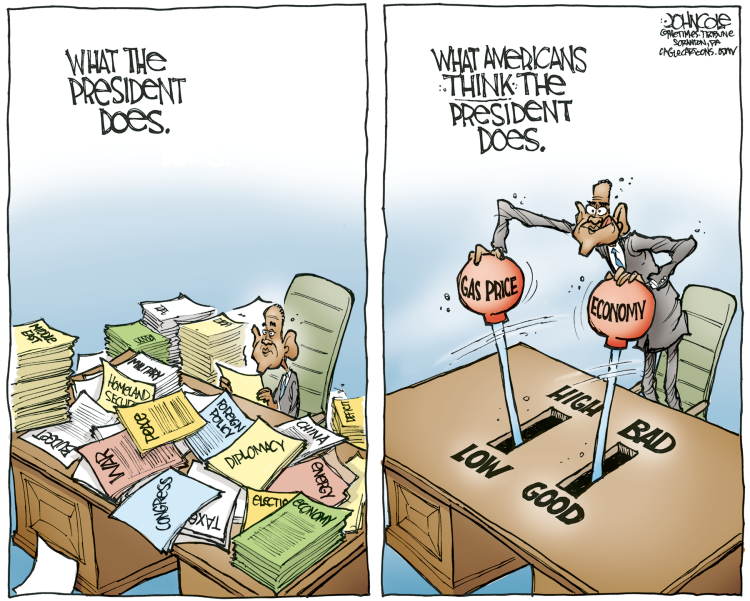

On 6/7/2022 at 9:12 PM, Texsox said:

@The Beast I agree. Gas seems to be the one thing that folks believe the president can control the price of. I've never heard anyone say that about the price of gold, olive oil, etc. I'm in Texas, I see all the pump jacks and off shore rigs but I've never seen a gas station selling cheaper US gas over imports. I've seen oil and gas companies in boom or bust cycles. Now that the cost of oil is high US production takes off. At $80 a barrel it's better left in the ground.

-

2

2

-

1

1

-

2023-24 NFL Season Thread

in A and J's Olde Tyme Sports Pub

Posted

https://www.nbcsports.com/nfl/profootballtalk/rumor-mill/news/bears-will-unveil-plan-for-new-stadium-in-chicago