-

Posts

185,258 -

Joined

-

Last visited

-

Days Won

533

Content Type

Profiles

Forums

Events

Everything posted by southsider2k5

-

I will grab one at Soxfest next year when it is $75 on the clearance rack.

-

Dang, now I want a Mercedes jersey.

-

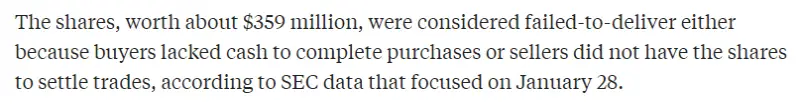

One thing of note is that it helps if you understand what the short ratio is. It is short interest compared to average daily volume. If it is above 100%, it just means there are more short positions than average trading volume. It isn't something taken against total shares or something like that. On FTD's the explanation is in there... and So in the case of the lack of cash, they are margin called. That isn't illegal. The second part of not doing a locate is a problem, and again those will be investigated and fines will happen for those as well. As I said before, Robinhood especially is going to be in a world of trouble just for their margin problems. if they, or any other firms, were allowing shorts without locates, they will pay for it. Finally you can argue that anyone did anything. Do you have evidence of coordination between the shorts? Because if you do, call the SEC and tip them. You will get a 10% reward that results in fines being paid. "I would argue" doesn't really do anything. Do you have email trails? Recorded calls? Because that is exactly how the LIBOR stuff was broken. There will also be plenty of people looking to see if there was coordination here, as there is a LOT of money to be made on fines and the like. If it is there, it will be found. There are billions of fines out there for institutions, as they are the people with the deepest pockets.

-

Today? Almost all electronic. You can still request physical shares, but no one really does it. It might even cost you these days. One of my older bosses first jobs was actually receiving and mailing stock certificates around for delivery and custody purposes. They are indeed client positions, but the firms is required to have cash on hand as well so that if individuals blow up, that they will still have enough cash to stay in business. There is a really long and complex set of rules around net capital requirements.

-

From a technical standpoint, a clearing firm has 2 days to move the shares from their custody to the custody of your clearing broker assuming it is not a day trade. Typically those shares move from Firm A to the DTCC (who is the main clearing agency in the US) to Firm B. If you are making the trade in cash, that money moves the opposite direction of the shares. If you are trading on margin your cash, plus the cash of the firm is moving. Typically a firm is required to hold enough net capital to cover 15% of the market value of its stock positions (its a little more complex than that, but for simplicity sake). If they are unable to deliver on time, then their requirements for cash go up, until they are required to hold 100% of the cash value of that stock in reserve.

-

Crimes for this guy? Right off of the bat, giving advice without proper disclosures for sure, even if he wasn't a part of the actual manipulation. It also sounds like he didn't disclose his outside business activities and trades as his firm is saying that they had no idea what he was doing. That is without even getting into how they view his trading behavior potentially as market manipulation to profit off of. I am sure they are investigating the first thing. My guess is that the firms who halted were in margin troubles, which is why they were stopping the additional positions. I would expect firms to pay a lot in fines in regards to them. Second, being short a stock isn't illegal as long as the short wasn't fraudulently obtained through something like a method of quickly exiting and re-entering the position so it looks like a day trade and not a held position. As long as proper trade procedures were undertaken, including short locates, proper margining, and proper labeling of positions, this isn't illegal. It is also not illegal as a firm to enter as big of a short position as a firm can legally obtain assuming they have the cash to cover it per margin/haircut rules. The only spot at which this could become illegal beside the above notations, are if they coordinated their trades with other outside interests for the purpose of market manipulation. That is where the reddit crowd is going to get hammered. They coordinated this. A great example of this is the LIBOR fixing scandal, which has cost something like 6 billion dollars in fines. Not familiar with what you are referring to in the 3rd part in detail, but fails are a HUGE issue in the market place right now. Each firm is required to either deliver stock, or in the case of a short position, to borrow it from another long position to be able to short it. FINRA is all over fails. Now understand that a failure to deliver by itself isn't a crime, but the firm must then take a cascading margin/haircut loss on the position until they have to have 100% cash coverage for the FTD position until they either get out of it or if they receive delivery. There are also steps that must be taken and reported for fails. Firms want nothing to do with fails. because of the ease of moving stock around in 2021 trades are 99.999999% cleared on time. This isn't like the old days where someone had to mail in an actual phsycial certificate of stock. Finally also realize that the SRO's in play here don't announce investigations to the public. They just start investigating and document requesting. I promise you that investigations have already begun at these bodies, even if you and I don't know about them. We might get a press release, but we will really know when FINRA starts fining, when the SEC starts charging people, and when the Wells letters start flying.

-

I am sick of pretending what he did decades ago and refuses to let go of is somehow clearance for him today.

-

He changed the game decades ago. The game has changed again since then. Repeatedly. But he wants to go back to the good ol days.

-

These are the types of cases that the FINRA/SEC has brought its entire existence. It is exactly what I said would happen based on what has always been done here. Especially people who are licensed have a set of responsibilities and rules to follow in these situations, and it doesn't matter what job they are, or are not doing. While the feds haven't gotten to him yet, they will. There will also be a lot more of these. Also for the record, one does not have to profit from market manipulation for there to be a crime. Mass Mutual is also going to get drilled into the millions for failure to supervise. Obviously I don't know the merits of this particular lawsuit specifically, but this guys worst days are still ahead of him. These agencies don't move fast, but they do move.

-

Yeah, having down time alone is good for the mind.

-

The best thing I ever did was take a paycut to leave a job I hated for one that paid less, but was more suited to me. It didn't take me much time to advance and make up the dollar difference. It is also sometimes worth leaving some dollars on the table to make your life balance better. I got headhunted a few years back and told the guy initially it would take 10's of thousands more dollars to get me think about leaving the job I was at now. Then they I started thinking about adding back the commuting times again, and declined to interview further because I can essentially make my own schedule here.

-

https://www.reuters.com/article/us-retail-trading-gamestop-classaction-idUSKBN2AH2LQ?utm_campaign=trueAnthem%3A+Trending+Content&utm_medium=trueAnthem&utm_source=facebook

-

To honor Rush Limbaugh's life this weekend was declared your own facts day. Really Midway got an inch and a half, but they said it was 21 inches in honor of the man himself.

-

One could even say... disrespectful to the game.

-

Long before there was Tim Anderson, there was Rickey Henderson

southsider2k5 replied to VAfan's topic in The Diamond Club

I would concede that we didn't need another thread for this with three other ones going on. -

They have definitely made some progress. The PP has been nuts.

-

-

It's an average of 25 million for a kid who could have gotten a 400 or 500 million deal in free agency.

-

Long before there was Tim Anderson, there was Rickey Henderson

southsider2k5 replied to VAfan's topic in The Diamond Club

So was Ron Gant... -

Long before there was Tim Anderson, there was Rickey Henderson

southsider2k5 replied to VAfan's topic in The Diamond Club

I will let you debate yourself since you again ignored the threads that already contained this propaganda to create a new thread. -

Only JR knew of new TLR DUI upon interview and hire

southsider2k5 replied to southsider2k5's topic in Pale Hose Talk

So you are doing exactly what you are complaining about as a way of telling other people not to do it. But we appreciate the lecture on how Tony is going to be great because he used to be great as a form of I told you so. You might as well get used to it. Jerry put this in place with zero input from anyone else. It is his fault this is happening, even when it was obvious it was going to happen. The Sox can write all of the propaganda around it they like, some people appear willing to eat it up by the plateful. But it doesn't invalidate the concerns that people have, no matter how much you lecture critics of the hire. -

-

-

^ For the record, THIS is exactly what I was referring to when I was talking about Boomer mentality. The game is changing, and he can't stand it, so he wants to drag it back to the last century. Pass.