Falstaff

Members-

Posts

807 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Everything posted by Falstaff

-

Poll: Predict Final Win Total for the 2024 Chicago White

Falstaff replied to South Side Hit Men's topic in Pale Hose Talk

118 wins -

Bullet Train

-

Is it too early to wish to start the Getz watch?

Falstaff replied to wrathofhahn's topic in Pale Hose Talk

in 20 years White Sox owner, Mellody Hobson, will present Chris Getz the John Schuerholz Award, for excellence in the GM role. Melody, " I want to thank Chris for his dedication and hard work and the 7 World Series titles." -

One part of trading Cease that I see San Diego ahead at this time is just how good of a dude Cease is. What a solid teammate Dylan has proved to be.

-

A Zavala YES.!!! I also like the young pitching Getz has added in this trade. I believe Getz maximized what he could get for Cease and both teams are satisfied.

-

Will any team give Trevor Bauer a last shot?

Falstaff replied to caulfield12's topic in Pale Hose Talk

Trevor needs to read Dale Carnegie's book, "How to win friends and influence people." I think it could pay off more than Reinsdorf's public relations speaking course at Trump University. -

Will any team give Trevor Bauer a last shot?

Falstaff replied to caulfield12's topic in Pale Hose Talk

I would say no MLB will give Bauer a shot at this time. Could present public sentiment change if more details come out, absolutely but Bauer is still a Richard, that isn't ever going to change. -

2 things that are going to happen: - The Sox will have a new stadium at the 78. - The Bears will have a new dome stadium. Now how it happens I can't tell you, but both will get done.

-

Giolito to the Red Sox, 2 years $38.5 million, Y1 opt out

Falstaff replied to Balta1701's topic in Pale Hose Talk

To bad for Gio, he is a good dude. -

I would gladly pick him up and drive to the airport, AMF.

-

Is You Is Or Is You Ain't a Sox fan

-

First 20,000 get a Star Wars Storm Trooper action figure.

-

Balmer is a Clipper fan's dream for ownership. The 2 guys I can think of that have more money than they know what to do with are the Mets & Panthers owners. I am not sure how that will all play out in New York and Charlotte, especially Charlotte. I wonder if the next White Sox owner is already negotiating with Jerry behind the scenes. I hope it's George Lucas's wife Mellody Hudson. She is a Southside Sox fan with access to billions of dollars.

-

Sox select John Schriffen to be TV PbP announcer

Falstaff replied to fathom's topic in Pale Hose Talk

I was thinking of some of the old time Sox announcers, Bob Elson, The Commander, Harry Carry, and of course Hawk Harrelson. Then I thought about a Chicago Bear announcer most probably never heard of, Irv Kupcient, he was Jack Brickhouse's sidekick. If you get a chance to look up his history, it is very interesting. My dad and brothers would mimic Irv and I always would crack up. As a kid I never knew how big a deal Kupcient was, but his column was huge in the entertainment industry. Irv played college football and then when on to referee in the NFL. He went on to work for the Sun Times and wrote a celebrity and political gossip column. Long before internet keyboard warriors and TikTok /YouTube influencers Irv was the guy. Every movie star and music celebrity would have a sit down with Irv at a night club / restaurant/ or local studio when they came into Chicago for a premiere. He really was a big deal back in the day because people got all their information from newspapers. On a sad note, his daughter moved to Los Angeles to pursue an acting career in tv/movies and was murdered. -

Sox select John Schriffen to be TV PbP announcer

Falstaff replied to fathom's topic in Pale Hose Talk

Schrif & Stoney will be great I like them already. I am looking forward to the regular season broadcasts. -

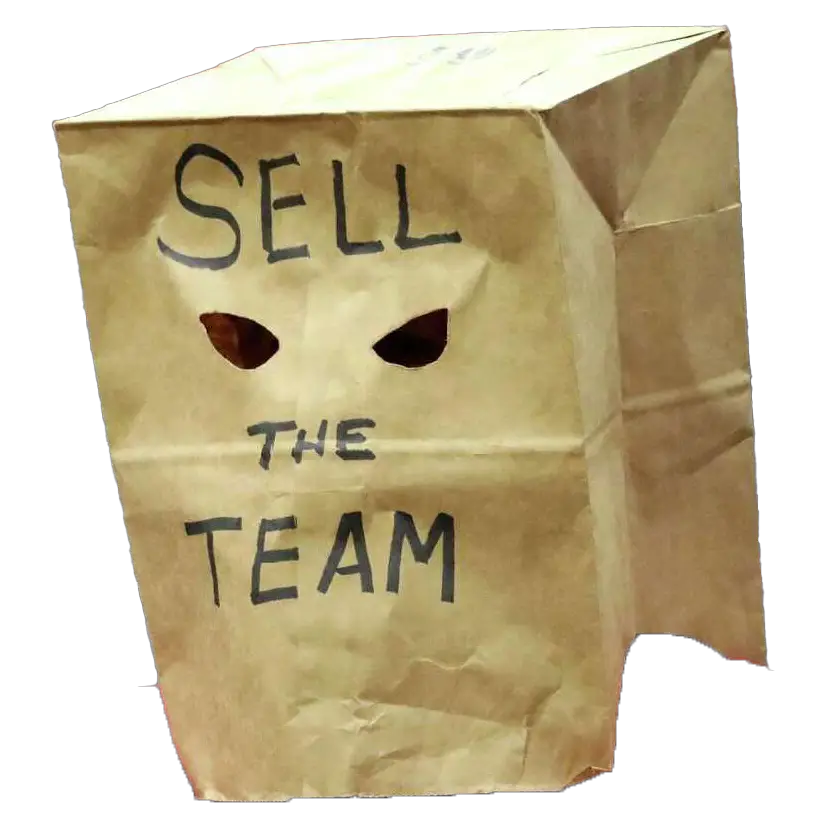

The Soxtalk Tea Party is formed and takes to the streets for fiscal responsibility in the great state of Illinois.

-

Regular season: 40,615 X 81 = 3,253,365 + (81 standing room only @ 500 = 40,500) = 3,293,865 This is without factoring in the White Sox home field advantage in playoffs and World Series where additional seats are typically added.

-

I am warming up to John Schriffen.

-

Lee and Elko look like they could play for the Bears.

-

Scoots if you are in a company 401k you might be able to move a percentage to a Roll Over IRA. I was able to move up to 20% out of my company 401K to a Roll Over IRA. You can transfer the funds to a Roll Over IRA at any institution like Vanguard or Fidelity. There are some very important rules on transferring the funds to avoid penalties. A timeline of 60 days, transfer the funds electronically without cashing a check if issued, a Roth Roll Over IRA would require you to pay taxes up front. The reason people do the Roll Over IRA is because sometimes their company 401K plan is limited in investment options.